Use Case

How a Leading Consumer Electronics Brand Leverages Wiser for Enhanced Market Presence

Learn More

Use Case

For this leading consumer electronics brand, fragmented data and manual checks made it difficult to maintain a reliable, shared understanding of the market. Answering basic questions about pricing position, availability, or competitive presence required stitching together inputs from multiple teams and tools. With Market Intelligence, the brand created a dependable foundation for understanding what was changing and where to focus.

Previously, understanding what was happening in the market required manual monitoring and reconciling inputs from multiple teams, tools, and timeframes. Pricing, availability, and competitive presence were visible in pieces, but not in a way that supported a consistent, shared understanding of market conditions.

This fragmented approach created real friction for teams. Time that should have been spent evaluating options or planning next steps was instead consumed by validating numbers, aligning on definitions, and reconciling conflicting views of the market. Meetings slowed down as teams debated which data source to trust, and decisions were often delayed while information was rechecked or updated. As a result, even straightforward market questions took longer to answer, making it harder for teams to move with confidence in a category where conditions can change quickly, influenced by marketplace activity and rapid price movement.

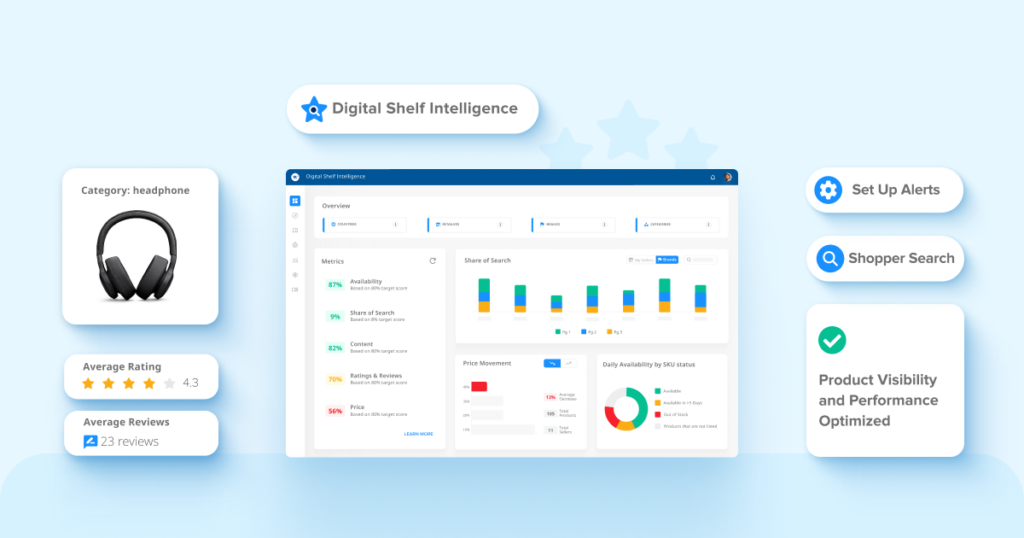

By using Market Intelligence to centralize these signals, the brand brought pricing across retailers, product availability, and competitive context into a single, standardized view across key retailers. Daily insights made it easier to see how products were positioned, where listings were present or missing, and how the broader competitive landscape was evolving, without relying on disconnected reports or ad hoc checks.

By consistently tracking how its products compared to competitors across retailers, in one single source of truth, conversations shifted away from debating whose numbers were correct and toward interpreting what the market was showing. Teams were equipped to monitor changes as they occurred, align around a shared set of facts, and make day-to-day decisions with greater confidence, grounded in a current view of market conditions rather than isolated or outdated snapshots.

Book a 15 min call with us today.