Gap 1

Aisle Context Blind Spots

What happens:

You see your items, not how the aisle is arranged or shifting.

Why it matters:

Range, space and adjacencies change shopper choice long before POS shows it.

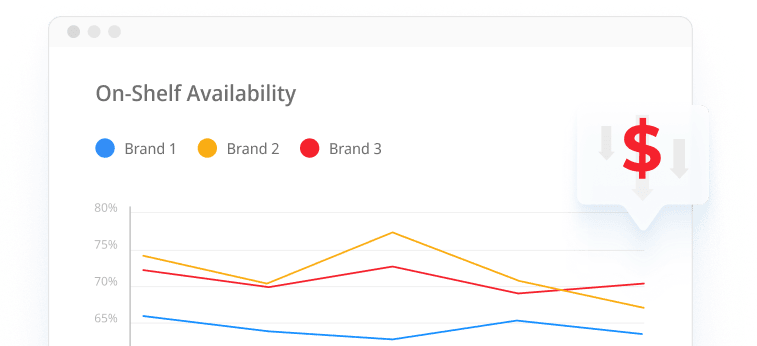

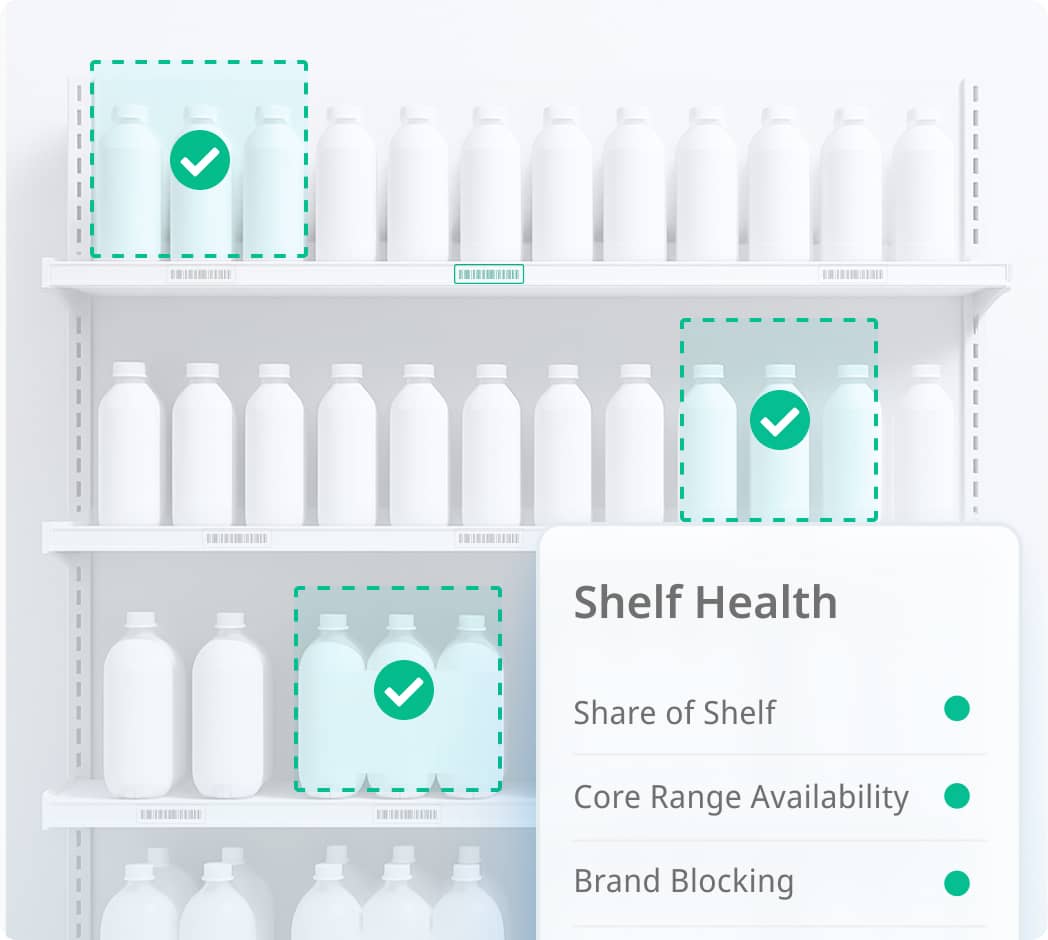

Shelf Health

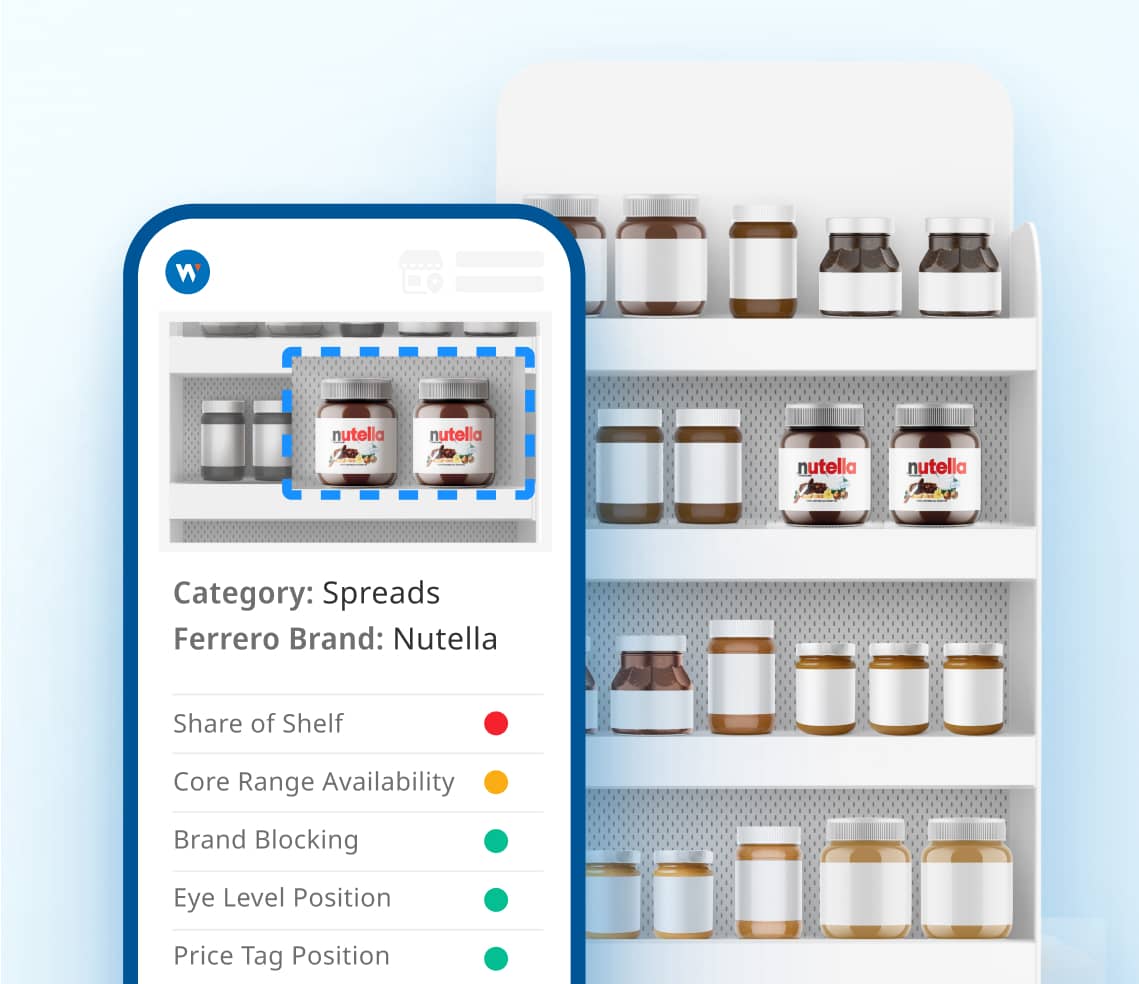

Wiser captures category context and competitive signals to add to your store view—data enrichment turns captures into comparable metrics your teams can act on.

Sales shows outcomes, not causes. Without category context—aisle dynamics, competitor secondary placements, feature activity, execution quality—you react late, miss easy wins, and struggle to defend decisions with retailers.

Gap 1

You see your items, not how the aisle is arranged or shifting.

Range, space and adjacencies change shopper choice long before POS shows it.

Gap 2

Rivals win off-shelf or cross-aisle features you don’t track.

Traffic and impulse go to them; your plans look underpowered without the context.

Gap 3

Facings shift quietly during resets or merchandising across banners.

Velocity dips look like demand issues when they’re really space losses.

Gap 4

You're shelved in a different section or with low-traffic adjacencies you can't control.

Strong SKUs get skipped when category placement isn’t as expected; this context explains sales swings and backs range/merch asks.

Gap 5

In-aisle cues (promos, pack offers, signage density) reshape how shoppers approach the shelf.

Mix and margin slide even with steady distribution; you need the context to understand.

We’ll scope a mission, run capture logistics, and return decision-ready measures aligned to your KPIs.

Let's Get Started

"We couldn’t see what was happening in key stores… With Wiser, we audited more stores and fixed gaps we wouldn’t have caught otherwise."

Alfonso Caballero

National Retail Operations Manager

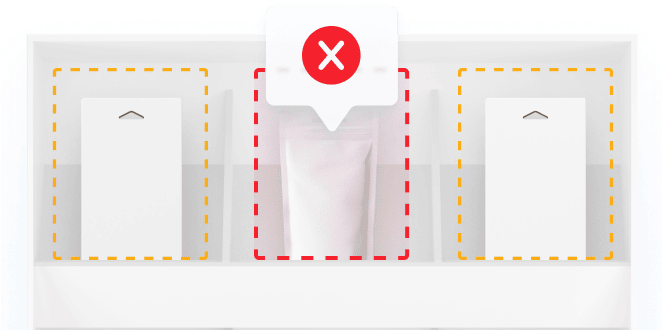

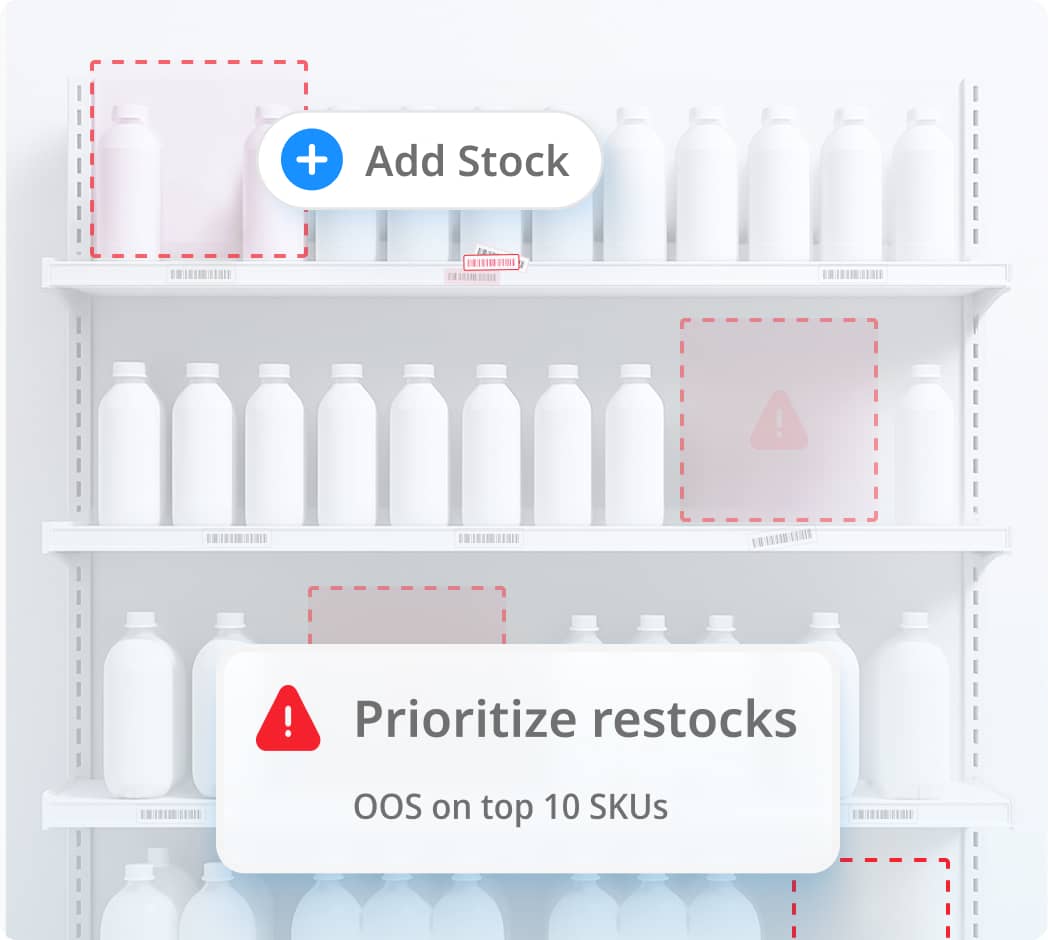

These in-store issues quietly cut into your margin, week after week.

Even brief stock issues quietly slash your weekly revenue.

High-value SKUs get buried, while slow movers take the spotlight.

If it’s not on shelf, it’s not in the basket. Your brand takes the hit.

By the time teams act, you’ve already lost the sale.

Trade dollars burn when displays stay in storage.

Get a quick read on the value of adding category context to your current view.

Estimate My ImpactTrack it. Diagnose it. Fix it. All without stepping foot in-store.

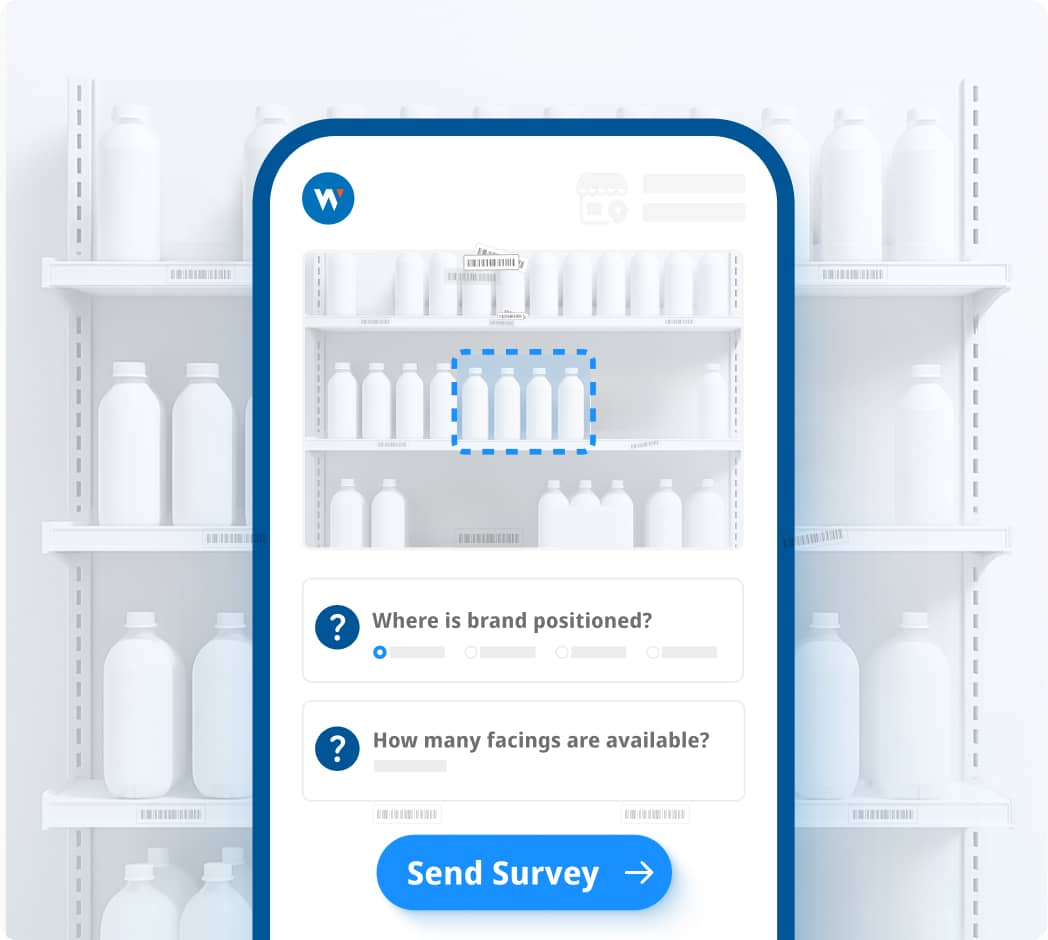

Shoppers collect shelf images and quick checks in your priority retailers, with targeted automation guiding tasks for consistent inputs.

Structured extraction and enrichment turn captured photos into comparable category measures across banners.

With apples-to-apples metrics, identify rising opportunities and retailer-specific risks as competitive shifts emerge.

Fold the insights into trade plans, buyer stories, and field tasks, then track outcomes to scale what works.

Close the gap between what you think is happening and what actually is.

Watch 3-Min DemoChallenge

Range and space calls rely on POS and partial photos, so competitor moves and aisle changes are hard to read.

Wiser Impact

Confident, data-backed recommendations on space, adjacencies, and secondary placement asks—category context your buyers can act on.

Challenge

Limited visibility into feature quality and competing activity makes promo results hard to explain or improve.

Wiser Impact

Verify execution and see competing features in the same period, so spend, timing, and tactics shift toward what actually moves the aisle.

Challenge

It’s tough to defend outcomes or secure commitments without a store-level story that shows what the aisle looked like.

Wiser Impact

Comparable aisle context alongside KPIs turns conversations into targeted commitments on space, placements, and timing.

Challenge

How shoppers encounter the brand in-aisle—visibility, presentation, value cues—may not match expectations, and it’s hard to see why.

Wiser Impact

Clarity on attention and presentation in the aisle to refine messaging and offers, align with real store conditions, and support growth campaigns.

Shelf photos and compliance dashboards powered Ferrero’s global execution rollout.

Solution

Result

4 min

A "Perfect Store Framework" is much more achievable than you think.

Watch videoCoverage paired with comparable category measures through structured processing.

150K+

Sellers Monitored

600K+

Tracked stores via flexible missions

63%

Productivity gain reported by teams using decision-ready metrics

10B+

Products tracked across programmes

Share your goals and KPIs. We’ll outline a practical plan to expand coverage, add the context you’re missing, and link actions to outcomes.