Impact 1

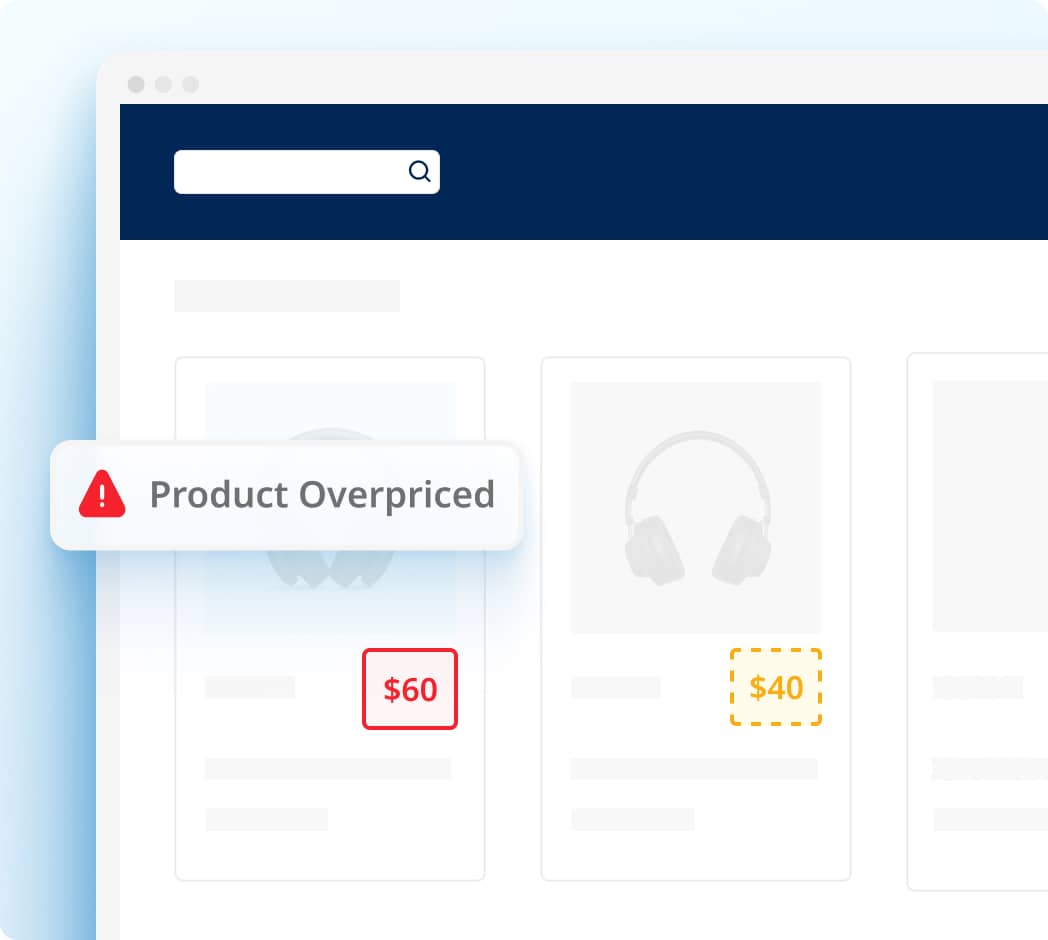

KVI Mispositioning Hits Conversion Fast

When visible items fall out of position, shoppers notice quickly, especially for Key Value Items (KVIs).

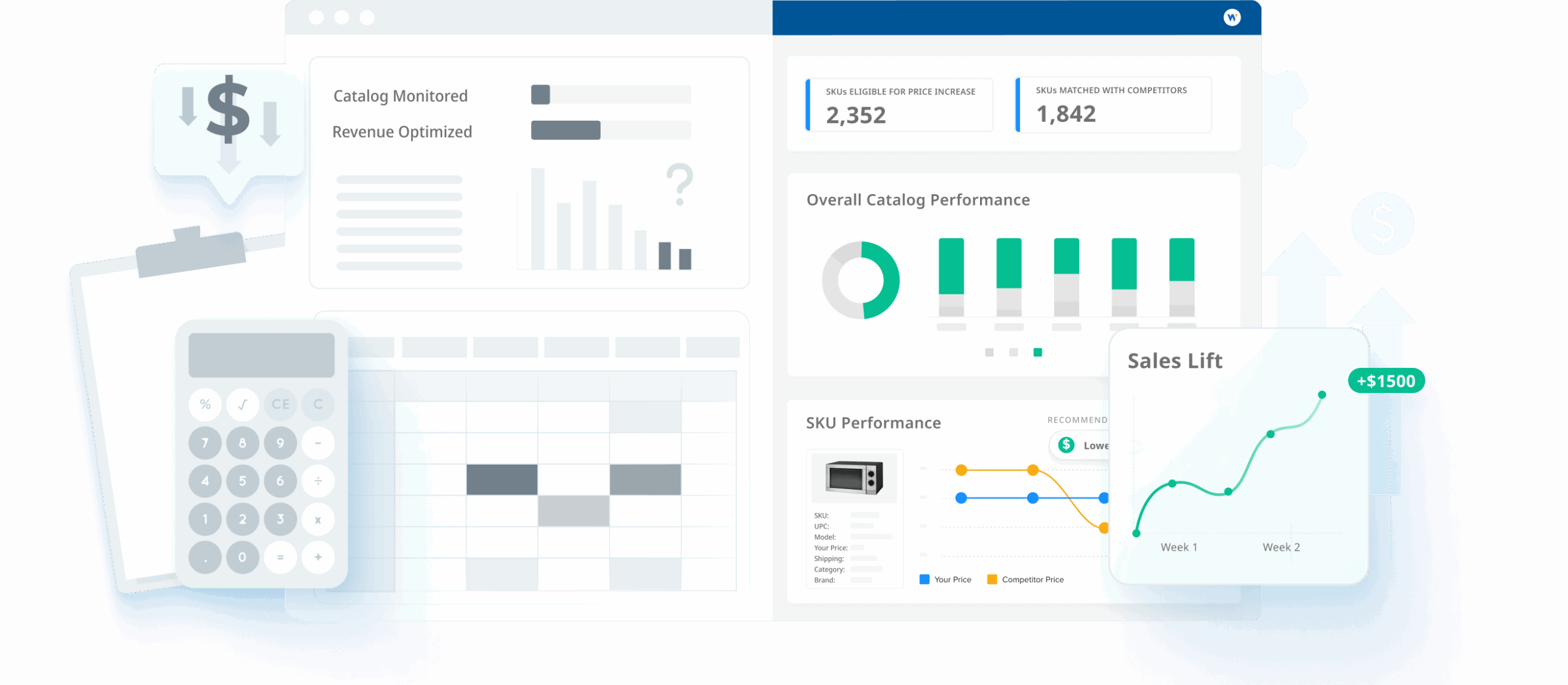

Price Monitoring

In categories with huge assortments, pricing gets messy fast. AI-powered price monitoring helps you stay sharp, control discount sprawl, and protect margin across the long tail.

What's at stake

Impact 1

When visible items fall out of position, shoppers notice quickly, especially for Key Value Items (KVIs).

Impact 2

Weekly promos and seasonal pushes spread too far when pricing tiers are unclear, driving unnecessary discounting.

Impact 3

By the time teams spot a competitor move, the promo window shifts and decisions turn into fire drills.

See how top solutions compare on features, accuracy, and coverage for high-SKU, promo-heavy retail.

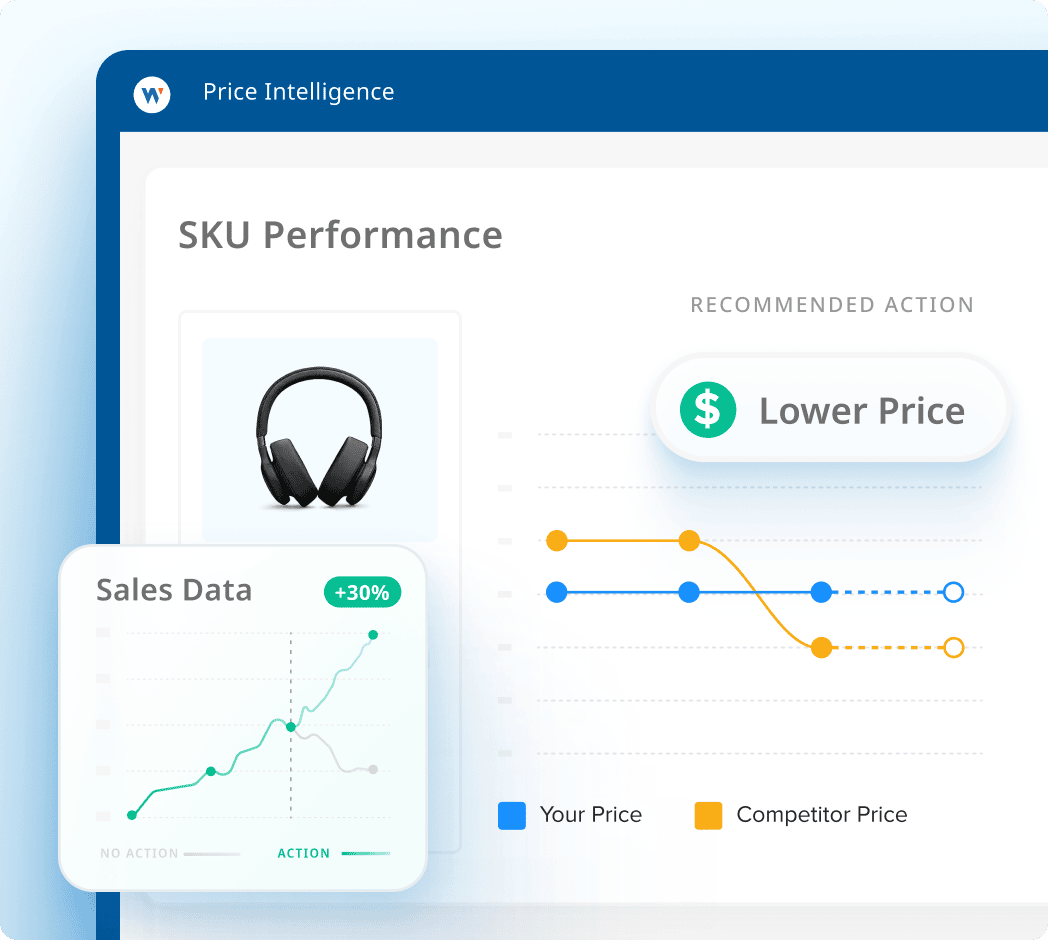

See the RankingsSmarter pricing doesn’t need a bigger budget. Wiser helps lean teams monitor the market and react in real time, without adding headcount.

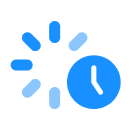

Match complex assortments, pack variations, and near substitutes to true like-for-like competitors without manual mapping.

Make pricing tiers explicit so teams stay sharp on the visible basket while protecting margin on the long tail.

Catch competitor changes as they happen and coordinate updates before the promo window shifts again.

Set thresholds, rules, and reporting that align teams and reduce opinion-driven pricing debates.

Explore our eBook on building a repeatable pricing program with clear governance and measurable outcomes.

Download eBookCompare ad hoc monitoring to a program built for high-SKU, seasonal, promo-heavy retail.

Big box retailer

"We only had visibility into 1% of our catalog. Now we monitor 15,000 SKUs daily, automatically matched across key competitors—unlocking hidden pricing gaps and untapped revenue."

Home improvement retailer

"We were spending 8–12 hours/week scraping competitor sites by zip code. Now we’ve reallocated that time to price strategy and testing new regional tactics."

Consumer electronics retailer

"Our Amazon sales jumped 15% with repricing. But our own site was lagging. With Wiser, we brought that same agility to DTC—fueling new growth."

Appliances retailer

"We uncovered that a key competitor was reacting to our pricing—because of Wiser’s crawl timing. That insight helped us reclaim £1M in revenue opportunity."

CPG retailer

"We used Wiser to identify the right competitors and price points to launch our DTC channel. The shift from guesswork to clarity was game-changing."

Identify KVI mispositioning, promo risk, and long-tail leakage in one view.

Book Time with UsAction

Automatically align your assortment to true like-for-like competitors across complex categories.

Outcome

Trusted comparisons that eliminate debate and speed category decisions.

Action

Monitor price moves across key retailers and marketplaces throughout promos and peak season.

Outcome

Faster reaction time on visible items without overcorrecting across the long tail.

Action

Set thresholds by category and KVI tier, with alerts routed to the right owner.

outcome

Governance that scales across pricing, merchandising, and ecommerce.

action

Track price and promo patterns by season, category, and competitor.

outcome

Better seasonal planning and fewer last-minute exceptions.

action

Deliver dashboards by role for ecommerce leaders, merchandising, and pricing managers.

outcome

Clear accountability and measurable outcomes by category.

Wiser’s take on how big data fits into modern price monitoring.

Play VideoCheap vendors promise speed, then leave you cleaning up bad data. Only accurate matches let you act fast and protect margins.

With Wiser, you get reliable insights to act fast and price with confidence.

See the Wiser Difference